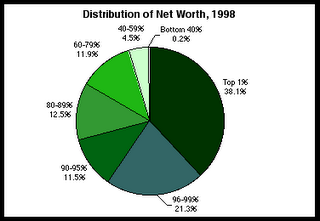

What does it mean for a tax plan to be "fair?" According to President Clinton's definition, a tax cut is equitable if the least productive people in the economy get the largest tax break and if the most productive people get no tax cut at all. Four years ago he made the amazing statement that his tax increase plan was "fair" because "70 percent of the taxes would be paid by the wealthiest 2 percent of the families."Okay, skipping the conceit that equates pay and productivity, I do think that Americans believe that those who benefit most from the nation's bounty ought to pay the most in taxes. I mean, why shouldnt the wealthy bear the brunt of the tax burden? After all, they bear the brunt of the wealth burden. And as most of us would like to find out, it's a dirty business trying to figure out how to spend hundreds or thousands of dollars every day, so why fight it when help comes along? Look, here's a pie chart showing wealth distribution in the U.S., circa 1998.

Americans do want a fair tax system. But by "fair" they do not mean the Clintonian notion of requiring the rich to bear almost all the tax burden.

But does a pie chart really get the idea across? Try this...

But does a pie chart really get the idea across? Try this... Another way to put it: Assume there are 100 people who have $100 to split up. No one expects it to be divided perfectly evenly at $1 apiece, but everyone involved expects that some basic fairness will be used in the process that will split up the money.What those Cato folks were aiming at was this idiotic idea, presented by Republicans in the last decade or so, that rich people wont continue to try and make money if taxes are high (when I say "idiotic" I refer to the people who believe it, not its obviously successful use). So far, I've not seen any evidence that anyone in the MSM has tried to dispute this idea. Who really believes that a) the money is the sole motivator of these people, and b) that they wouldnt try to become (or indeed, be) really really rich even if the government took away 50%, or even 75% of their income? Were you aware that from WWII to 1961, the rate of taxation for the highest bracket was 94% (though, no doubt, just like today, there were plenty of loop-holes)?

Now let's say the $100 winds up being divided as follows:The 40 people getting 1/2 cent each might be a bit annoyed at the person getting $38.10. The 20 people getting 23 cents each would probably not be happy with the 4 people receiving $5.32 each. And so on...

- 1 person gets

- 4 people get

- 5 people get

- 10 people get

- 20 people get

- 20 people get

- 40 people get

- $38.10 each

- $5.32 each

- $2.30 each

- $1.25 each

- .60 each

- .23 each

- 1/2 cent each

This is how our economic system has distributed the wealth of our country. It's so far from any type of fairness as to be laughable, were it not a direct cause of certain segments of our society lacking adequate resources for food, clothing, shelter, medical care and other necessities, let alone any amenities of a beyond-subsistence life. (props to The Rational Radical)

Are you going to try tell me that the 50's were a period of major economic stagnation? That's funny, I always thought it was the period that conservative groups hold up as the nation's Golden Age. Well, gee, I guess it was the period when the Middle Class grew by leaps and bounds, and that's certainly bad for rich people (or must be, since they're getting all the tax cuts lately, and the Middle Class is shrinking while the Rich get richer). But hey, maybe only the Rich are able to invest in the economy, while all that middle class people can do is buy lots and lots of stuff and try and put aside a bit for a comfortable retirement (and that's not good for the economy, is it?)

And why do the rich insist on acting like their achievements have been made by them and them alone? No CEO ever did anything by himself. But because workers are easily replaced, they are considered fair game for being lowballed, both in terms of pay and benefits. Funny that no one thinks Executives (which you need far fewer of) are so easily replaced, but then who's doing the replacing?

Hey, I know, how about a sports analogy? Everyone loves sports analogies:

Imagine that a sports team wins the Championship, then has to sit and listen while the owner tells everyone how the team won because of his brilliant ownership, awards himself a fat bonus, and says, by the way, next year he'll be charging the team for equipment and field rental (it will later be revealed that the company supplying the equipment is run by the owner's brother-in-law)(and anyone living in a major city knows who actually paid for the field).

Then the owners of the losing teams get up, blame the unions for their losses, and then announce that in addition to the equipment charges and rentals, players will have to start paying for their own medical care (hear, hear! says the winning owner, a capital idea!).

The players revolt, strike and are replaced by scabs, because, after all, there are only a few owners, but lots of people want to play football.

Think I'm being silly? Of course I am, players have the backing of the public to keep them in the money. But imagine if those players didnt have the legions of fans devoted to their cause, but were more like, say, air traffic controllers? Now am I being silly?

Here, let's make it a bit simpler. Who has more money left over after paying for the basics of life; food, housing, clothing, transportation, stuff like that? Never mind the quality of these things, for this point we can ignore the diffence between the palatial homes of the rich and the ratty slums of the poor. Let's talk about after all the "basics" are paid for (however extravagant they may be), who then has money for more stuff? Second home at the beach? Month in Europe? 40' cabin cruiser? Vintage sports car for weekend getaways? Not the poor. These are the lifestyles of the rich and famous, and who, other than the Rich, isnt against taxing excess (the more wretched the excess, the better).

I'm not saying that I wouldnt have all of these things if I could. I would.

I'm also not saying that I would resent paying taxes if I was wealthy. Hell, I resent paying taxes now that I'm poor. But I also resent giving my kids ice cream drumsticks, because I'd rather hog them all myself. But I share anyway, because that's what responsible adults do.

Paying taxes is what responsible citizens do.

Has anyone ever considered the idea that today's "starve the beast" republicans (many actually Libertarians) are really just anarchists in disguise?

2 comments:

Interesting post.

I actually agree that the tax codes aren't "fair" because fair is a subjective term. As you point out, whether someone thinks they are fair depends on what THEIR definition of fair is, not someone else's.

I'm not sure that taxes have anything to do with fair or if they even should.

Taxes are a way to fund things that the government does. You don't get to earmark your taxes, if you did we wouldn't be in Iraq. You pay them for the common good.

Sometimes we use them to induce something we decide is "good" (like tax breaks for a company to build a plant). In some cases, the money made back in the form of taxes from workers makes that a good investment. Sometimes not.

I like to look at taxes not in terms of fairness, but what they pay for. Can I pay for more things by ponying up about 33% of what I make or a person making 10X as much who ponies up 33%?

There's your answer.

I don't believe that rich people should be taxed at overwhelmingly higher rates, but I do expect them to pay in rates comparable to other people and that simply doesn't happen.

You can argue about redistribution of wealth, but the fact is, society benefits as a whole (including the rich) if you do that and I think that's why I lean more toward the left rather than the right side when it comes to taxes.

I really LOVE the hell out of your sports analogy Dave :)

Post a Comment